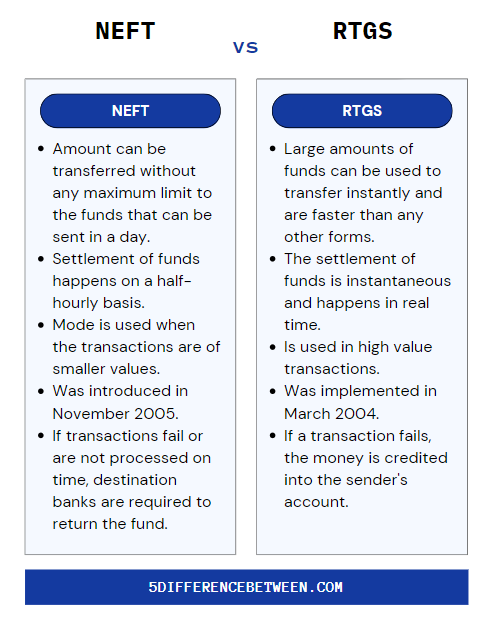

NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) are the two most important modes of digital funds transfer in India (Real Time Gross Settlement). The Reserve Bank of India (RBI) says the difference between NEFT and RTGS helps in transferring funds from one bank account to another. Although both payment systems are used to transfer funds, there are significant differences between them.

To know the difference Between NEFT and RTGS it’s important to understand what they are.

What is NEFT ?

NEFT (National Electronic Funds Transfer) is a Reserve Bank of India (RBI) online banking service that allows customers to transfer funds from one bank account to another using an electronic payment system. It is an important financial transaction tool because it eliminates the need for manual processing and enables customers to transfer funds quickly and securely. Customers can use NEFT to transfer funds from one bank account to another. Customers must provide their bank account information, the bank account information of the receiver, and the amount to be transferred. After that, the sender’s bank will send a message to the receiver’s bank, which will process and transfer the funds to the receiver’s account.

Benefits of NEFT

The primary benefit of NEFT is that it is a safe, efficient, and cost-effective method of transferring funds. It is also convenient because it can be done at any time and from any location with an internet connection. Furthermore, it is an instantaneous transaction, which means that the funds are transferred almost immediately.

NEFT is also a secure method of money transfer because it is protected by the RBI’s security measures. These include data encryption, sender and receiver authentication, and two-factor authentication. All of these precautions ensure the safety and security of funds transferred via NEFT.

Also Read > Difference Between Guarantee and Warranty

Apart from individuals, businesses, particularly those that need to send large sums of money to other banks, use NEFT. It is also used by small and medium-sized businesses (SMEs) to make payments to their suppliers. Overall, NEFT is a safe and convenient method of moving money from one bank account to another. It is a valuable tool for individuals, businesses, and SMEs because it enables them to make secure and timely payments.

What is RTGS ?

The Real Time Gross Settlement (RTGS) payment system allows for the immediate transfer of funds between two financial institutions. It is a safe and secure payment method used for large-value transactions, typically those worth more than 2 lakhs. RTGS is India’s fastest domestic money transfer system, allowing fund transfers to take place on the same day.

RTGS transactions are settled in real-time, which means that funds are transferred and available for use immediately. This ensures that the funds are not held up in the banking system and are immediately available to the beneficiary. RTGS is an interbank money transfer system, which means it is only available to financial institutions such as banks and non-bank financial companies. By entering the account number and the amount to be transferred, funds are transferred between banks or from a bank to a customer.

The Reserve Bank of India monitors and regulates RTGS transactions (RBI). All RTGS transactions are subject to the RBI’s rules and regulations. As a result, there are some limitations on the amount of money that can be transferred via RTGS. The minimum and maximum amounts that can be transferred are 2 lakhs and 10 lakhs, respectively.

Benefits of RTGS

RTGS is a simple and secure method of transferring funds within the country. It is a safe and dependable method of transferring large sums of money in a short period of time. It is important to note that RTGS transactions are irreversible, which means that they cannot be reversed once funds have been transferred. As a result, RTGS is a safe and dependable method of transferring funds.

Finally, RTGS is a convenient and secure method of transferring funds within India. It is a safe and dependable method for transferring large sums of money quickly. It is governed by the RBI and is subject to certain limitations. Furthermore, RTGS transactions are irreversible, making them a safe and dependable method of transferring funds.

NEFT Vs RTGS

These two types of electronic fund transfer systems: NEFT and RTGS. NEFT are a paperless and secure method of transferring funds from one bank account to another. RTGS is a high-value transaction system that is much faster than NEFT. Both are safe and secure modes of electronic fund transfer that are widely used for payment in India.