Whether you’re an aspiring business owner or simply curious about corporate structures, chances are you’ve come across the terms “holding company” and “subsidiary company”. They sound very similar, but there is an important distinction.

Holding and Subsidiary Company

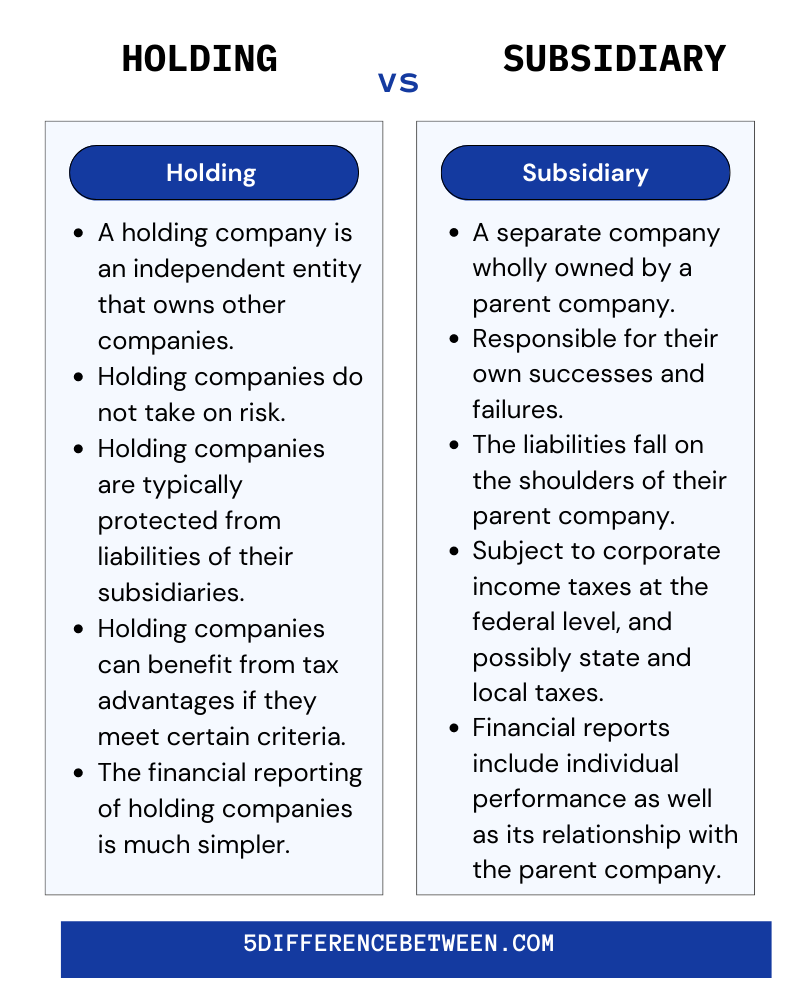

A holding company is a parent corporation that owns enough voting stock in one or more other companies to control their policy and management. It generally does not produce goods or services; rather, it aims to own shares of other companies to form a corporate group.

Also Read > Difference Between Compiler and Interpreter

A subsidiary company is any business that’s majority-owned by a larger parent company. This type of company will generally have most of its operations managed by the parent, although it may also retain some self-governance. In other words, it’s an organization in which the parent has a controlling interest or ownership stake – usually at least 50%. This can be an ideal arrangement when a corporation wants to expand its operations into new geographical areas without having to invest heavily in new infrastructure and staff.

Holding Company Vs Subsidiary Company

Are you wondering what is the difference between a holding and subsidiary company? Many people confuse the two, so here are five key differences to help you better understand:

Making the Right Choice

Now that you know the two basic definitions of a holding and a subsidiary company, it’s time to ask: when is it appropriate to use one? To answer that question, you have to look at the differences between the two — namely, ownership and liability.

When a holding company owns another company or asset, it will have full control over that asset. This means that the holding company can make decisions without having to consult any other parties or regulators. Additionally, a holding company is not liable for any debts or losses of its subsidiaries. On the other hand, a subsidiary will generally be held liable for its own debts and losses. In some cases, though, a parent company may be held liable for its subsidiary’s liabilities—for example, if they have provided guarantees to shareholders or creditors. So depending on your investment strategy and risk appetite, either type could be the right choice for you.

So there you have it — the key difference between holding and subsidiary company. Now that you know what sets them apart, you can take the right steps to determine which one suits your needs best!

One Comment to “5 Difference Between Holding and Subsidiary Company”