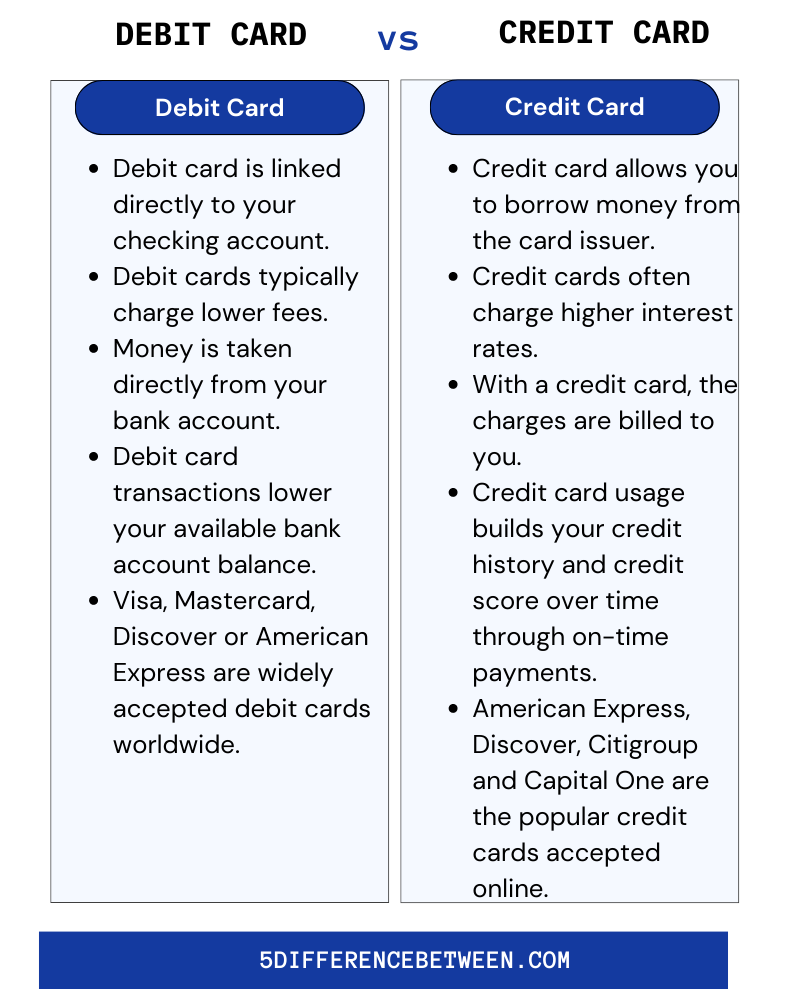

When it comes to making payments or purchases, the two most common options are debit cards and credit cards. While they may seem quite similar, there is difference between debit card and credit card you should understand before deciding which is right for you.

How Debit Cards Work

A debit card is eventually linked directly to your checking account. When you make a purchase with your debit card, the money is immediately deducted from your available balance.

Also Read > Difference Between College and University

When you use your debit card to pay for something, the amount of that transaction is deducted right from your checking account balance. This means you can only spend what you actually have in the account. The transaction is authorized based on your current balance, and the amount is deducted almost instantly.

If there aren’t enough funds in your account to cover the transaction, it will be declined. So keeping a register of your purchases and an eye on your balance is important. Some banks do offer overdraft protection which will allow transactions to go through even if you overdraw your account, but fees will apply.

The main benefits of using a debit card are avoiding debt and interest charges, ease of use, and convenience. The downsides are that your spending is limited to the money in your account and that you typically don’t get rewards like you would with many credit cards.

How Credit Cards Work

Credit cards allow you to make purchases now and pay for them later. How? The credit card issuer lends you the money for your purchase. You then pay the issuer back, often over time and with interest charges.

With a credit card, you get an initial grace period – usually around 3 weeks – to pay back what you owe without incurring interest charges. If you pay the full amount within that grace period, you’ll pay no interest. But if you only make a minimum payment, the remaining balance gets carried over to the next month and interest starts accruing. Those interest charges and fees are how credit card companies make money.

The main benefits of credit cards are convenience, rewards, and fraud protection. But if used irresponsibly, credit cards can lead to debt. The most important things are to use your card within your budget, avoid racking up interest charges, and pay on time each month.

Some tips for using credit cards responsibly:

- Pay on time. Late or missed payments hurt your credit and incur fees.

- Avoid cash advances. They start accruing interest immediately and often have higher rates.

- Be wary of high-interest store cards. Their APRs are frequently higher than regular credit cards.

- Check your statements regularly for errors or fraud. Report anything suspicious immediately.

Debit Cards Vs Credit Cards

In summary, weigh the pros and cons of each option based on how you prefer to spend and pay, as well as fees and your financial goals. For many, a combination of debit and credit cards works well to maximize the benefits and minimize costs. But choose carefully and spend responsibly!